AACSB Quick-Take Survey on COVID-19: Business Schools Brace for Admissions and Enrollment Impacts

AACSB continues to monitor the impacts of COVID-19 on its business schools through its quick-take member surveys. Our most recent survey focused on potential impacts schools anticipate in their admissions and enrollment, as well as the strategies that schools are considering or already planning to implement to offset such impacts.

Recruitment and Admissions

A total of 227 AACSB member schools participated in the survey, with a regional breakdown of 48 percent in the Americas; 20 percent in Asia Pacific; and 32 percent in Europe, the Middle East, and Africa. Respondents were asked to indicate actions their schools were taking to address recruitment and admissions challenges resulting from COVID-19, for both their undergraduate and graduate programs.

For undergraduate programs, we found that increasing scholarship support/financial support was the most common action across total responses globally, but we see more variation when looking at the breakdown of specific global regions. In the United States the majority of institutions replied that they waived testing requirements, while in Asia Pacific the most commonly reported action is increased scholarship support or other student financial aid, and in Europe and the Near East the most common action by schools is postponing application deadlines. In the Middle East, most institutions indicated increasing scholarship support or other student financial support.

For graduate program recruitment and admissions, the most commonly reported action in response to the pandemic is postponing application deadlines. However, in the United States the most reported action is waiving testing requirements (50 percent of respondents), which is less common in Asia (15 percent) and in Europe and the Near East (11 percent).

Anticipated Actions

Respondents were asked to indicate the types of actions they expect to implement for their upcoming academic terms/sessions, as well as identify actions that have already been decided, are under consideration, not being considered, or not yet discussed/unsure of. Some schools indicated more than one term start over the next six months. One major finding that stands out is that a significant majority of respondents indicated that they are not actively considering actions including the following: canceling the term/session entirely, reducing the number of courses, relying on courses available through another higher education provider, and relying on courses through a non-higher education provider. This response is consistent across terms beginning in each of the next six months.

Many schools (47 percent) are still considering shifting their courses and programs online for their upcoming terms; however, a view of the next six months shows variation in implementation. For instance, 95 percent of schools with terms beginning in the month of May have decided to offer courses and programs wholly online/virtual. This figure slowly drops to 76 percent in June and 62 percent in July.

Among schools with terms beginning in August and September, there is a steep drop to 7 percent of schools and 6 percent of schools, respectively, having already decided to shift wholly online/virtual, and a corresponding steep increase in the percentage of schools that are considering but uncommitted to such a move.

This suggests that in the short term, schools are continuing with online instruction and are still hopeful that in August through October the situation may improve to allow for face-to-face learning.

The second most common actions under consideration are to modularize the term into multiple smaller sessions, and/or defer the start date of the session. Multiple shorter sessions were reported as “under consideration” for 27 percent of the terms starting in May through October, weighted toward those beginning in the later months. Deferring the start date of the session is “under consideration” for 24 percent of terms starting in May through October. Again, only a small handful of schools have decided to take these actions.

| Table 1. Actions Schools Anticipate Implementing | ||||

|---|---|---|---|---|

| Yes, decided | Under consideration | No, not being considered | Not yet discussed/ Unsure | |

| Wholly online/virtual | 31% | 47% | 13% | 9% |

| Further “modularization” of the term into multiple shorter sessions | 2% | 27% | 58% | 13% |

| Deferral of term/session start | 9% | 24% | 55% | 13% |

| Reduced set of courses | 4% | 16% | 68% | 11% |

| Reliance on courses or modules available through another higher ed institution | 0% | 3% | 85% | 12% |

| Reliance on courses available through a third-party provider (non-HE) | 0% | 3% | 84% | 13% |

| Canceling term/session entirely | 1% | 2% | 89% | 8% |

A small but notable segment of respondents (24 percent) indicated plans to add new degree or non-degree programs specifically in response to newly emerging needs. The most common addition is non-degree programs, reported by 12 percent of schools, followed by master’s programs (10 percent), and undergraduate programs (7 percent).

Expected Enrollment Change

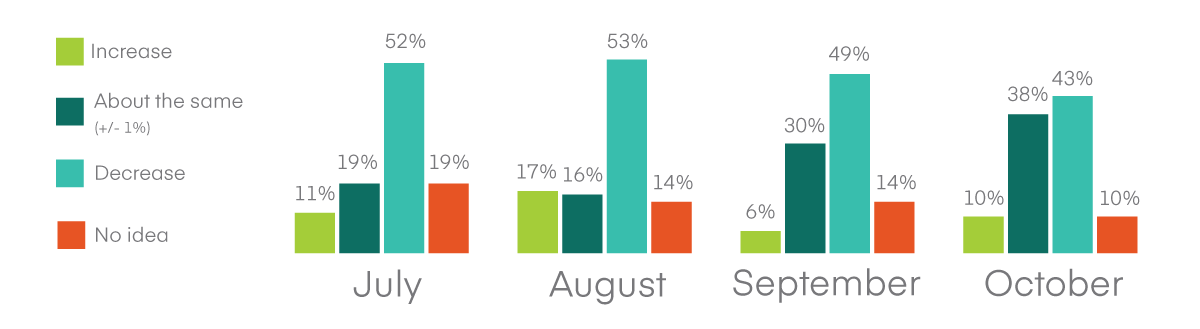

Overall, 46 percent of schools are expecting a decrease in enrollment in their terms beginning within the next six months, while 27 percent anticipate about the same enrollment (fluctuating by +/- 1 percent). However, we see differences in how schools anticipate enrollment being impacted from month-to-month. For example, in May, 33 percent of schools expect no change in enrollment, 31 percent expect a decrease, and 27 percent expect an increase. Among schools with terms beginning in July or August, over 50 percent expect to see a decrease in enrollment. Although a large number of schools still expect a decrease in enrollment in the terms beginning September or October, a growing number of schools are also reporting expectations of unchanged enrollment numbers.

*Percentages may not add up to 100 due to rounding.

Figure 1. Percentage of Schools Expecting Enrollment Change

*Percentages may not add up to 100 due to rounding.

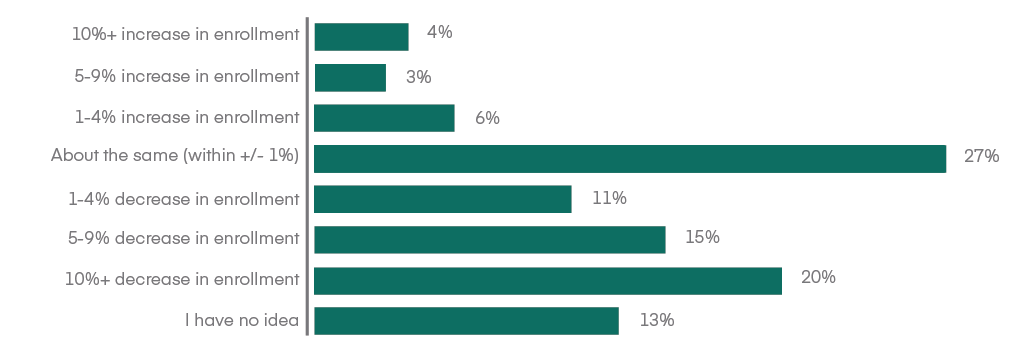

Figure 2. Anticipated Enrollment Changes Across All Term Starts.

For anticipated enrollment changes, respondents were also asked to identify how large or small the potential impacts would be. Among respondents anticipating an enrollment increase, a 1-4 percent increase was most commonly reported, while for those anticipating an enrollment decrease, a 10 percent or greater decrease was most commonly reported.

Our findings suggest that, just like in most industries around the world, business schools and higher education are experiencing a high degree of uncertainty for what the future holds, especially in regard to enrollment and recruitment efforts. We are seeing that business school leaders are taking into consideration various scenarios that could change from month to month. Many of the differences across enrollment impacts and anticipated changes are and will continue to be dependent on what part of the world a school is located in, as well as what many of our schools would point out—differences in the types of students they attract, their missions, and other specific contexts and qualities.